Small businesses use the COA to organize all the intricate details of their company finances into an accessible format. The chart of accounts clearly separates your earnings, expenditures, assets, and liabilities to give an accurate overview of your business’s financial performance. A Chart of Accounts is an organized list of all the accounts in a company’s general ledger, systematically used for recording transactions. Each account in the COA is typically set as a unique identifier, often a number, and is organized to reflect the business’s structure and reporting needs.

Why You Can Trust Finance Strategists

- Small businesses with fewer than 250 accounts might have a different numbering system.

- So, a chart of accounts, as mentioned, organizes a company’s finances in an easy-to-understand way.

- Here’s how to categorize transactions in QuickBooks Online and navigate the COA.

- It brought the concept of recording transactions with corresponding debits and credits, allowing for more accurate financial records.

- The general ledger serves as the central repository for all of a company’s financial transactions.

Integration enables real-time access to financial data, empowering businesses to generate up-to-date reports and conduct immediate analysis. This timely access to information aids in informed decision-making and allows for quick adjustments based on current financial insights. Establish a hierarchical structure that aligns with the business’s operations and reporting requirements. Group similar accounts together under relevant categories for easy navigation and comprehension. Examples include accumulated depreciation (offsetting the asset’s value) or allowance for doubtful accounts (offsetting accounts receivable).

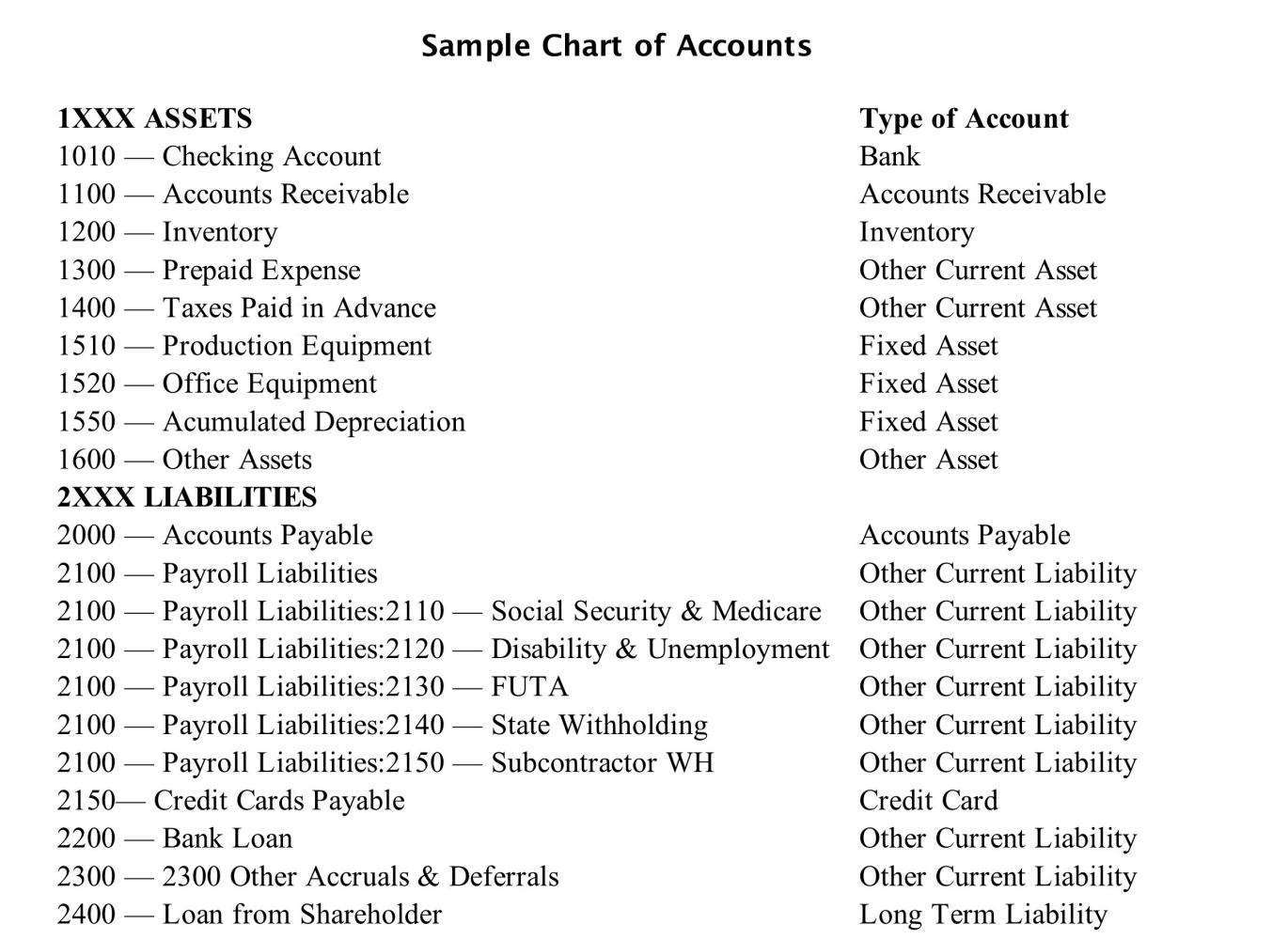

Sample Chart of Accounts for a Small Company

The first digit in the account number refers to which of the five major account categories an individual account belongs to—“1” for asset accounts, “2” for liability accounts, “3” for equity accounts, etc. The role of equity differs in the COA based on whether your business is set up as a sole proprietorship, LLC, or corporation. This would include Owner’s Equity or Shareholder’s Equity, depending on your business’s structure. The basic equation for determining equity is a company’s assets minus its liabilities. A chart of accounts has accounts from the balance sheet and income statement and feeds into both of these accounts.

Example of an account numbering system:

In 1494, an Italian mathematician, Luca Pacioli, wrote a book providing suggestions of how merchants could keep their records. It was like the first try to introduce double-entry bookkeeping, being a significant milestone. It brought the concept of recording transactions with corresponding debits and credits, allowing for more accurate financial records. While Pacioli’s work laid the foundation for modern accounting, a standardized chart of accounts had yet to emerge.

Liabilities

Income accounts are instrumental in assessing the profitability and operational efficiency of a business. Further information on the use of debits and credits can be found in our bookkeeping basics tutorials. Have you ever wondered how a well-structured Chart of Accounts could streamline your financial reporting? Stick with us as we reveal the key elements and benefits of mastering this essential tool.

Chart of accounts: Definition, how to set up, and examples

For instance, whether it’s a corporation, partnership, or sole proprietorship. Let’s look back in history to see how people came to the idea of having the chart of accounts as an accounting necessity. In manufacturing, the production process involves different tax credit vs tax deduction stages, such as raw materials, work in progress, and finished goods. TYou can keep track of these stages with the Raw materials inventory, Work-in-progress inventory, and Finished goods inventory accounts, monitoring the value at each production step.

Think of debts to suppliers, loans from banks, or unpaid expenses – they are your liabilities. The total assets amount represents the value of all the company’s resources. Some businesses can indicate COGS, gain and losses, etc., as separate accounts to structurize their finances even more granuarly. The account’s unique identifier (e.g., 1010.1) is used to specify where the debit or credit is to be recorded. On the other hand, organizing the chart with a higher level of detail from the beginning allows for more flexibility in categorizing financial transactions and more consistent historical comparisons over time.

See a free Excel template with a standard chart of accounts with payroll expenses, etc. Importantly, the COA is designed to be adaptable, evolving with the business to include new accounts as necessary, ensuring its continued relevance. This systematic categorization aids in adhering to regulatory requirements, facilitates in-depth financial analysis, and supports informed decision-making. Additionally, by streamlining accounting processes, the COA enhances efficiency and minimizes errors – a critical advantage for businesses with complex transactions. The group refers to the categorization of the account into one of the headings shown below.

Leave a Reply