Appoint a trustworthy individual as the custodian who will be responsible for managing the petty cash fund. Since the petty cashier does not have to collect, he can now make the small expense recording more accurate. The finance team will verify the past expenditures and send a cheque for petty expenditures for the next period. Many small businesses don’t have a formal system for petty cash—owners will simply pay out of pocket for small expenses and hope nothing goes wrong. It sure would be nice to have some spare cash around to pay for these small business expenses, wouldn’t it?

What is petty cash book? How it is prepared? Types, Format, Pros and Cons

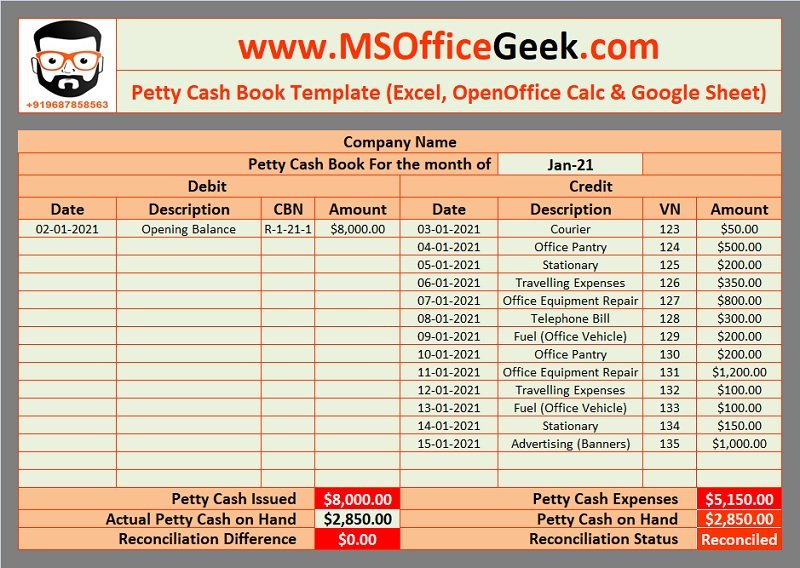

- Cash received by the petty cashier is recorded on the debit side, and all payments for petty expenses are recorded on the credit side in one column.

- From the initiation of the journal, the ledger account is prepared, with the help of which the final books of accounts of the company are prepared.

- Regular reconciliation reveals the true extent of cash usage, facilitating timely fund replenishment and preventing potential disruptions due to shortages.

- They’ll usually keep it in a lockbox or a cash register, and will have some kind of system in place to make sure none of it gets lost.

Petty cash is a small amount of money kept on hand by a business to cover minor, day-to-day expenses. In the world of business finance, petty cash might seem like a small change, but it can make a big difference in your day-to-day operations. This often-overlooked financial tool is the unsung hero of smooth-running businesses everywhere. The cash book is the main book, whereas the petty cash book is in support of the cash book. The petty cash book reduces the burden of larger and heavy amounts of cash paid or received.

Determination of expenses

Though not literally cash, it’s money that can be easily and quickly accessed, which is why it’s “on hand.” Cash on hand is any accessible cash the business or liquid funds have. It can be in the form of actual money, like amounts you haven’t yet deposited in the bank or smaller bills and coins that you keep in the cash register to make change for customers. If there’s a shortage or overage, a journal line entry is recorded to an over/short account.

Do you already work with a financial advisor?

In the reference or ledger folio column, the accountant inputs the account number for the related general ledger account. From the following information please show a simple petty cash book for the 1st week how puerto ricans are fighting back against using the island as a tax haven of Jan YYYY. This means any cash that the petty cashier receives is recorded on the left-hand side (debit side) of the book whereas any cash that is paid is recorded on the right-hand side (credit side).

Ensure timely replenishment of funds

Each entry in the petty cash book should include the date, the amount, and what was purchased with the petty cash. Review your petty cash register before you replenish the petty cash fund. 🚨 It’s important to note that while petty cash transactions may seem minor, they still need to be accounted for accurately. The IRS and other tax authorities require businesses to keep records of all expenses, regardless of size. Proper petty cash accounting ensures you’re prepared for audits and have a clear picture of your business’s financial health. A cash book is set up as a subsidiary to the general ledger in which all cash transactions made during an accounting period are recorded in chronological order.

Because a petty cash voucher is made out for all disbursements, the total of the vouchers and the remaining cash should always equal the amount of the fund (in this case, $100). Depending on your industry and location, maintaining a petty cash fund might complicate regulatory compliance. Without strict controls, employees might be tempted to use that cash on hand for personal expenses or fabricate receipts.

While you’re doing this, it’s a good idea to decide what expenses qualify for petty cash disbursement. Maybe you treat your employees to pizza Fridays, but you probably don’t want to pay for their daily lunches. Petty cash float is the amount which company allows the responsible person to control, and any amount over that must be deposit to the bank. It depends on several factors, such as the demand for petty cash during regular operation. However, we also need to consider the risk of fraud if the float amount is too high as the payment through petty cash does not go through management approval. Separate columns are used for each expense in ‘Analytical petty cash book’.

The petty cash start at any fixed balance at the beginning of the month, and it will reduce over time due to expense. At the month-end, the balance must be replenished back to the float limit. The amount of cash allocated for petty expenditures for a specific period is entered on the credit side of the general cash book and on the debit side of the petty cash book. This column is used for expenses that are insignificant and do not fall under any other columns of commonly occurring expenses in the analytical petty cash book. Record the following transactions in a simple petty cash book for the month of January 2019.

Hence, the sum of all receipts plus the ending balance should be equal to the petty cash of $500. By setting these guidelines, you can avoid misunderstandings or misuse, and your petty cash system keeps expenses quick to resolve and easy to track. The cashier needs to prepare petty cash top up when the amount falls below the minimum balance. The petty cash must keep in a proper locker in order to prevent any thief or miss place which can lead to the loss of company assets. If the amount is significant, the cash should keep in safe and key need to separate to more than one person. Any cash received by the cashier is recorded on the debit side of the book.

Leave a Reply